How to Run your Finances As A Freelancer or SoloPreneur (In Texas 2020)

Posted by Cameron Shaw on

It’s a hectic and uncertain time, but perhaps there’s never been a better time for you to figure out how make money using just your brain and a laptop with internet. It’s not easy, but it’s very, very possible, and ever so rewarding. The lifestyle attainable is my proudest accomplishment - total freedom in the work that I do, who I do it for, when I choose to work, and from where I want to work.

The entrepreneurial lifestyle isn’t for everyone, but if you think it might be for you, here’s an overview of a few things to keep in mind.

Firstly - taxes and legal structure. Oh, goodness - does the lawman already want a cut? Not quite - if you’re just getting started out, you’re perfectly free to provide goods and services to other individuals or to businesses without any legal structure or any paperwork being filed - until you’ve earned $600 from them. So - depending on the nature of the business you start, you may not need to file any legal documents at all - just get started! It’s on a per-client basis, so you could have 5 clients all pay you $599 and earn $2995 in your first month, and none would need to give you a w9 or anything!

But, quickly, you’ll need to set up a legal entity to do business as. The most common form and the one I use is an LLC. The rules for these differ slightly by state, but the general idea is the same: You create a business entity with which to conduct business, and if the business incurs liabilities or debts then you aren’t personally on the hook - it falls to the business. Hence the name - Limited Liability Company. It exists to provide a way for individuals to be more risky in business since they don’t have to worry about the bank coming after their home if the business goes under. It’s a system. In practice though, and especially for single member LLC’s, your credit score will take a dive if your business defaults on debts. They won’t take your house, but they won’t forget (for seven years at least).

Creating a business structure is fairly straightforward, and many companies you can find online will submit all the required paperwork and legal documents to get you incorporated in your state. I used LegalZoom and it cost about $330 and I haven’t had any issues.

Once you have a business structure in place, you can officially sign documents and enter into agreements as the business rather than yourself personally. Start doing this and thinking about it as a separate entity as much as you can. If your type of work involves contracts or legal documents, you can find many good templates online and often even state specific ones. I’d recommend using these as a starting point (though oral contracts are legally binding in Texas and most work I do is done over a handshake rather than a signature).

At this point, you need to also do a bunch of research and if you can connect with other freelancers in the same profession & industry to try to answer the question: do I need to pay Sales taxes on my services? The answer will not be straightforward. The answer will not be easy to find. You will get different answers from different people. Do your best to follow the spirit of the law and the letter of the law, and oftentimes your best judgement is the best that you can do. In general if you’re selling something physical you will be charging sales tax, and if you’re selling services or something virtual - I wish you the best of luck in ascertaining the taxation eligibility for each of your services.

So, now that you’ve chosen to tax or not tax your services, and you’ve got an LLC set up and entered into a business agreement or sale with a client, and the money is coming through the door - what next?

Well - the first thing to understand is that the money that’s coming through the door is not yours - it belongs to the business. I’ve found that this mindset shift makes a lot of things more palatable. When a client pays you $100, that $100 needs to cover all the operating costs of the business, and a portion of it will be claimed by Uncle Sam at the end of the year. Unfortunately, there’s no way to know how much Uncle Sam will be taking. It’s important to understand that when you’re working for yourself there is no employer withholding taxes for you - at tax time, there is no built-up tax return against which to apply your actual taxes. Brief recap: when a full time employee is paid their salary, the company sends a check for 10-15% of the total to the government in order to contribute to social security and medicaid among others. At the end of the year, you file your taxes reporting your income and calculate taxes owed. Often times the taxes owed is less than the taxes your employer set aside for you, so the government returns that balance to you as a Tax Return. If you’re a freelancer, there is no company setting aside this for you - and don’t think for a second the government doesn’t still need it - so you must set it aside for yourself.

So - when $100 comes in, about $12 - $15 dollars goes to Uncle Sam, about $3 will go to bank processing fees, so that leaves $85. My business is very lean, but I still pay for subscriptions to github, zoom, and some other services, so I need to add in some buffer to account for that.

Now, this either goes one of two ways. You underpay yourself and your business always has cash in the bank, and it builds up over the year until you cut a big check to uncle sam, and then you have cash left over to give yourself as a bonus.

Or, if you overpay yourself and underestimate your expenses or your tax liability, then you cut a check to Uncle sam, don’t have enough that month to pay for subscriptions, and you reduce your own ability to generate new income because you’re now lacking tools.

Cashflow is king. You should aim to never be underwater, not ever.

I set aside 30% of everything that comes through the door. Roughly half of that will go towards taxes, and the other half will mostly go towards yearly expenses, but planning for some to be left over.

The 70% is paid straight out to me as soon as it comes in, and that’s the money you live on.

Some quick napkin math to illustrate some numbers:

If you want to live off of $2000 per month, then you need to bring about $2800 through the door.

For $4000 / month, it goes to $5700.

Goes up fast, don’t it?

But, fly by these numbers and you have a good shot of making it. At the end of the year, going back to that same $100 - if real tax liability ends up being 8%, and real business expenses end up being 4%, then you’ll have $18 out of every $100 you made that year saved up to give yourself as a bonus - woohoo! Using this method the bonus usually ends up being 1-2 months of my average take home. It does arrive after the holiday season, however.

That’s the jist of it. There’s some annoying bits, but it’s doable.

A couple other things to be aware of… if you’re in Texas and operating a business, every year you have to submit a “Franchise Tax” report. It only applies to companies making over 1Million/yr. If this isn’t you, have you to let them know every year that once again you’ve failed to make a million. They’ll send you a letter and End Your Right To Transact Business In The State Of Texas if you ignore it. A phone call and a $60 fee will get you reinstated.

Around November/December each year you’ll start getting a bunch of people asking for W9 and hearing about 1099s and such. Let me make it simple. Remember how earlier I said that the government doesn’t care if someone gets paid under $600 by someone else? Well, if there IS anyone who you (personally or as a company) have paid more than $600 in the calendar year, then the government would like you to please tell them who that is please. If you paid a contractor or other company more than $600 for goods or services, you need to send a 1099 to the government saying “Hey I paid X this much money” so that the government can make sure they’re paying taxes on it. As a courtesy, we also send this to the person we’re reporting the income towards. So, if you offer your services to a bunch of different clients and make more than $600 from them in a given year, they’ll each need to send you a 1099 which will show the amount that they paid you in the year. When you file your own taxes, you’ll put each client as a 1099 with the amount you made from them, and then have a general misc income for anyone who didn’t send you a 1099 out of negligence or didn’t make the $600 threshold.

...Another thing that’s worth mentioning is that it’s not always super straightforward as to how you will actually get paid. Some companies want to pay an invoice with a credit card, some want to cut and mail a physical check, some want to send you a direct ACH deposit. The first thing I’d recommend doing is setting up a new business bank account right when you get started. All money that comes into the company goes there first, and then is paid out to you, spent via debit card on company expenses, and accumulates over time to go towards your taxes. Having these separate is extremely useful. I use separate institutions for my personal and business.

...The second year you’re in business the IRS has a treat for you. Remember how when you’re a full time employee the company gives the IRS a tax payment on your behalf every two weeks? Well, see it just doesn’t make sense that Self-Employed folks would get to hold onto their money the whole year and keep the interest. So, starting your second year you’ll need to give Uncle Sam the tax you’ll owe for that year… throughout the year. In 4 easy payments. Now you might be saying “But Cameron! How can I pay taxes at the beginning of the year without knowing how much money I’ll make during the year?!” A reasonable question. The answer is they just assume you’ll make the same this year as last. So, you’ll pay a quarter of last year’s total tax each quarter this year, and then pay or get a small difference at the end. Starts in year two for obvious reasons.

I use a handful of different payment processors for different clients, all funnelling into my my business bank account. I’ve very old school in my accounting and bookkeeping. The software I’ve used is needlessly complex for me, so I’ve returned to the simple spreadsheet.

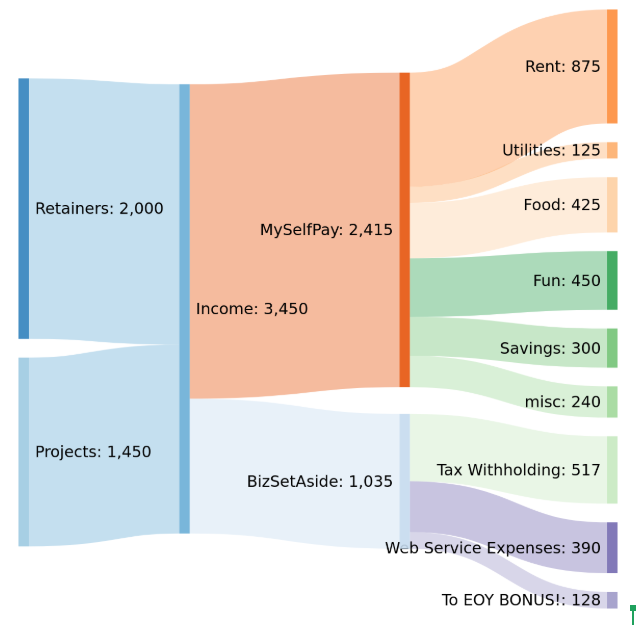

A sample budget breakdown for the month would look like this:

I use two spreadsheets to keep track of hours, know where my invoices are, and see where all the money went.

Here’s a monthly budget shapshot:

https://docs.google.com/spreadsheets/d/1LHgoVfrxsHGx7LatAm0pL4h6yTWm5Sdn5MaSsmh1gCo/edit?usp=sharing

Here’s my monthly invoicing status and invoice calculating sheet:

https://docs.google.com/spreadsheets/d/18eoaUtglGDoH1D7E2HHhTfA1GGtT_J0wmjeBnSoMzOA/edit?usp=sharing

Add your hours, check invoicing totals, and then update the statuses as they roll in.

Did I miss anything? Any questions? Feel free to write in! :)

Share this post

- Tags: freelancing